SPANISH LISTED ICT SECTOR: A quantitative review of equity evaluations and performance

- Guillermo Serrano

- Apr 23, 2023

- 1 min read

Updated: May 17, 2023

We have observed a 9% positive share price performance of the Large Caps versus a 5% decline for the Small Caps, during the last 12 weeks till 21st April 2023 (from the week commencing the 30th of January).

Our estimates/consensus point towards a 2023 positive Ebitda growth of 6% for our Large Caps universe and a 28% increase for the Small Caps.

Our projections leave the 12-month fwd EV/Ebitda multiples of the Large Caps at 7.8x (vs 7.6x on January 30th) whilst the Small Caps are now at 13,5x (vs 14.7x on January 30th). Still Small Caps trade at a 73% premium multiple versus the Large Caps.

Telefónica on 5.2x is the lowest EV/Ebitda multiple among the Large Caps, whilst Catenon (6.2x), Llorente y Cuenca (7.5x) and Gigas (7.5x) are the lowest multiples in our Small Caps universe.

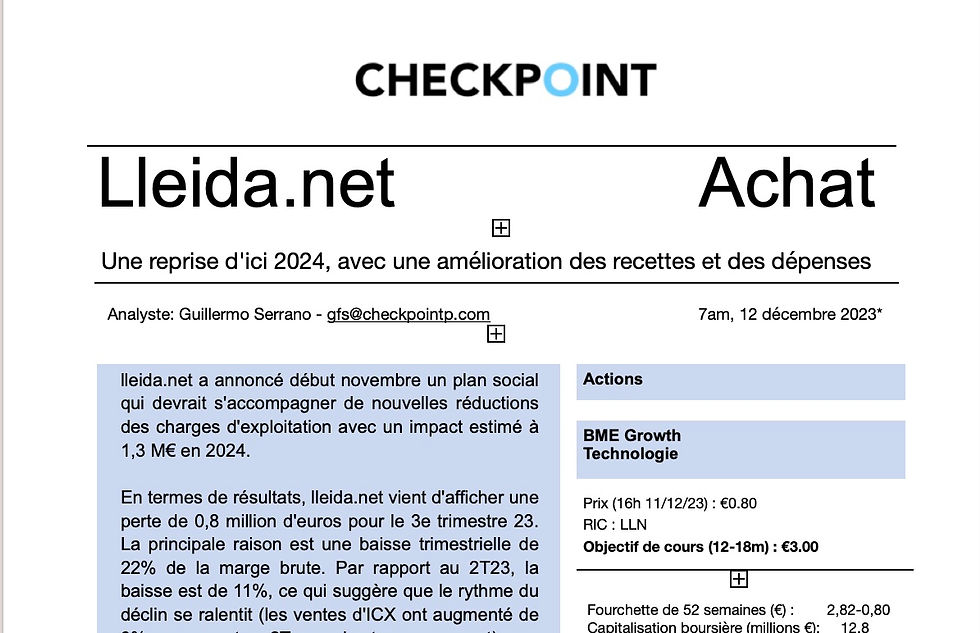

The highest Ebitda growth projections in 2023 belong to Lleida Net (+199%) and Netex (+284%)

Comments